Furthermore, it’s very important to know the phrases and circumstances absolutely.

Furthermore, it’s very important to know the phrases and circumstances absolutely. Hidden fees can sometimes be a surprise for debtors who don't read the fantastic print, resulting in unexpected financial burdens down the l

After you've got compiled your documentation and assessed your credit, it’s time to shop for lenders. Seeking pre-approval from multiple institutions allows you to examine charges and terms effectively. Once you select a lender, you can formally submit your utility, which can involve filling out a detailed kind and offering the mandatory docume

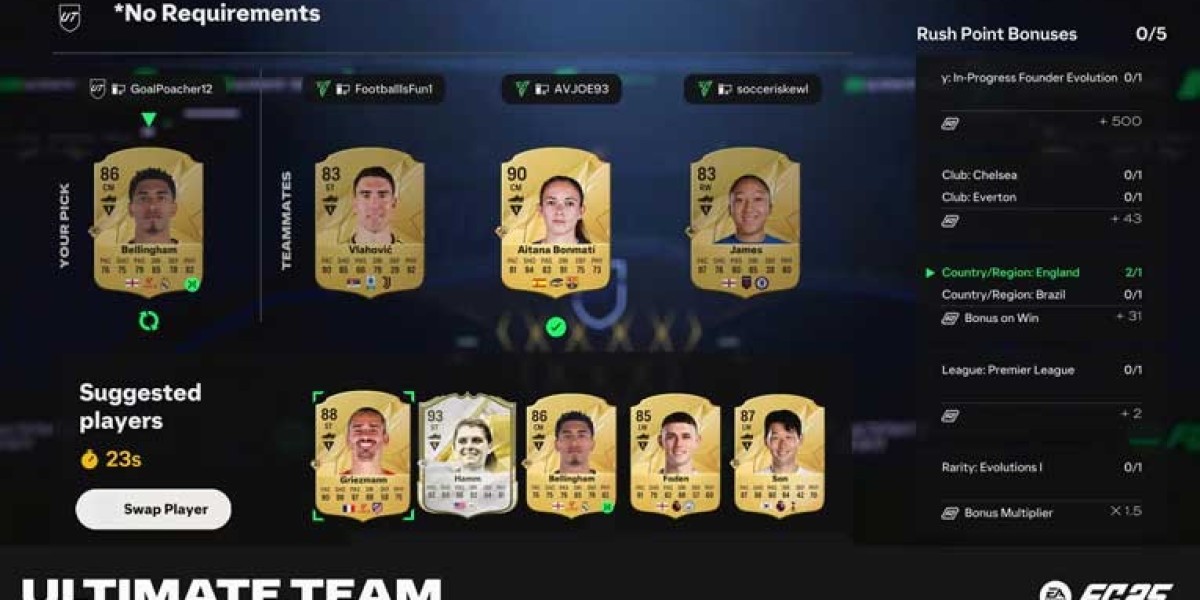

Mobile Loans vs. Traditional Loans

When comparing cell loans with conventional loans, a number of key differences emerge. Traditional loans usually require thorough credit score Other Loans checks and extensive documentation, which can delay the approval course of. Conversely, cellular loans are probably to utilize streamlined digital approaches, permitting faster assessments with out sacrificing secur

Benefits of Real Estate Loans

Real estate loans offer a quantity of advantages for debtors. First and foremost, they supply the financial means to purchase property without having to pay the total price upfront. This permits individuals and businesses to capitalize on real property opportunities whereas leveraging their capital successfully. Additionally, real estate loans usually have comparatively low-interest rates compared to unsecured lo

Another benefit is accessibility. Many freelancers, self-employed people, or those with unconventional earnings sources may battle to qualify for conventional loans due to documentation necessities. No-document loans can present a priceless various, allowing these people to acquire financing with out proving a standard inc

Understanding Small Loans

Small Amount Loan loans are sometimes defined as personal loans that function borrowing limits of up to a few thousand dollars. They typically come with shorter repayment intervals, making them interesting for these in want of quick money. Unlike larger loans which will require extensive credit score checks or collateral, small loans can be more accessible for people with various credit score backgrounds. Due to the comparatively lower danger concerned, lenders could offer more favorable phrases, corresponding to decrease interest rates or fewer fees. However, understanding the intricacies of these loans is essential earlier than committing t

However, traditional loans usually offer decrease interest rates for patrons with strong credit score histories. Therefore, it is important for debtors to gauge their financial standing earlier than deciding which loan sort fits them fin

The Importance of a Good Credit Score

Your credit score rating is amongst the most influential elements in figuring out your mortgage eligibility and interest rates. Lenders evaluate your credit history to ascertain the risk concerned in lending to you. A credit score above seven hundred is usually considered

Other Loans good, whereas scores below 600 may present challenges in securing favorable loan phrases. Maintaining a healthy credit score score can considerably impact the financing choices out there to

Daily

Emergency Loan providers have turn out to be more and more popular in right now's fast-paced financial landscape. These loans present convenient access to cash for those who might have short-term financial solutions. Whether it's an surprising expense, a medical bill, or a need for quick cash circulate, daily loans have gained traction amongst individuals looking for instant assistance. This article goals to explore the assorted features of daily loans, together with their advantages, how they work, and what to suppose about earlier than applying. Additionally, we are going to introduce BePick, a dependable platform offering complete information and critiques about daily lo

When to Consider a Small Loan

Small loans are perfect in situations the place immediate funds are required, but the quantities wanted are relatively modest. Typical scenarios include urgent residence repairs, sudden medical bills, and even seasonal bills similar to vacation shopping. They also can help people aiming to consolidate minor money owed into a single fee, potentially simplifying management and minimizing interest pri

Furthermore, mobile loans cater to varied wants, from personal loans to enterprise financing, catering to a large viewers. This flexibility makes them interesting, particularly to those that may not have qualified for conventional loans because of strict crite

It is essential to know that the underwriting process can range widely by lender and mortgage sort. Some loans could have streamlined processes, while others can take longer, especially if further documentation is required. Being proactive and clear in the course of the utility course of usually helps keep away from delays. Additionally, staying organized and conscious of lender requests can contribute to a more environment friendly utility experie

Betting on Thrills: The Ultimate Playbook for Sports Gambling Enthusiasts

بواسطة Jaclyn Henning

Betting on Thrills: The Ultimate Playbook for Sports Gambling Enthusiasts

بواسطة Jaclyn Henning Bet Big, Laugh Hard: The Ultimate Guide to Winning at Sports Betting

بواسطة Jacques Schwarz

Bet Big, Laugh Hard: The Ultimate Guide to Winning at Sports Betting

بواسطة Jacques Schwarz Bet Like a Pro: The Ultimate Korean Sports Betting Playground

بواسطة Harold Waterhouse

Bet Like a Pro: The Ultimate Korean Sports Betting Playground

بواسطة Harold Waterhouse Five Sectionals For Sale Near Me Projects For Any Budget

بواسطة Lavonne Bustos

Five Sectionals For Sale Near Me Projects For Any Budget

بواسطة Lavonne Bustos 10 Reasons You'll Need To Be Educated About Wood Burner Fireplace

بواسطة Adell Middleton

10 Reasons You'll Need To Be Educated About Wood Burner Fireplace

بواسطة Adell Middleton