How to Apply for No-document Loans

Applying for a no-document loan usually includes a streamlined process compared to traditional loans.

How to Apply for No-document Loans

Applying for a no-document loan usually includes a streamlined process compared to traditional loans. Typically, a borrower can start their utility online or instantly with a lender. The preliminary step usually requires primary personal information corresponding to name, contact information, and the asset to be used as collate

The website offers comparisons of varied lenders, detailing rates of interest, terms, and buyer critiques. By using BePick, borrowers can make informed choices that align with their monetary targets and circumstan

Several elements influence your ability to obtain a Real Estate Loan. Lenders usually take a look at your credit score, income, debt-to-income ratio, employment historical past, and the quantity of down fee. Each of these components performs an important function in assessing your creditworthiness and figuring out the

Business Loan quantity that you may qualify

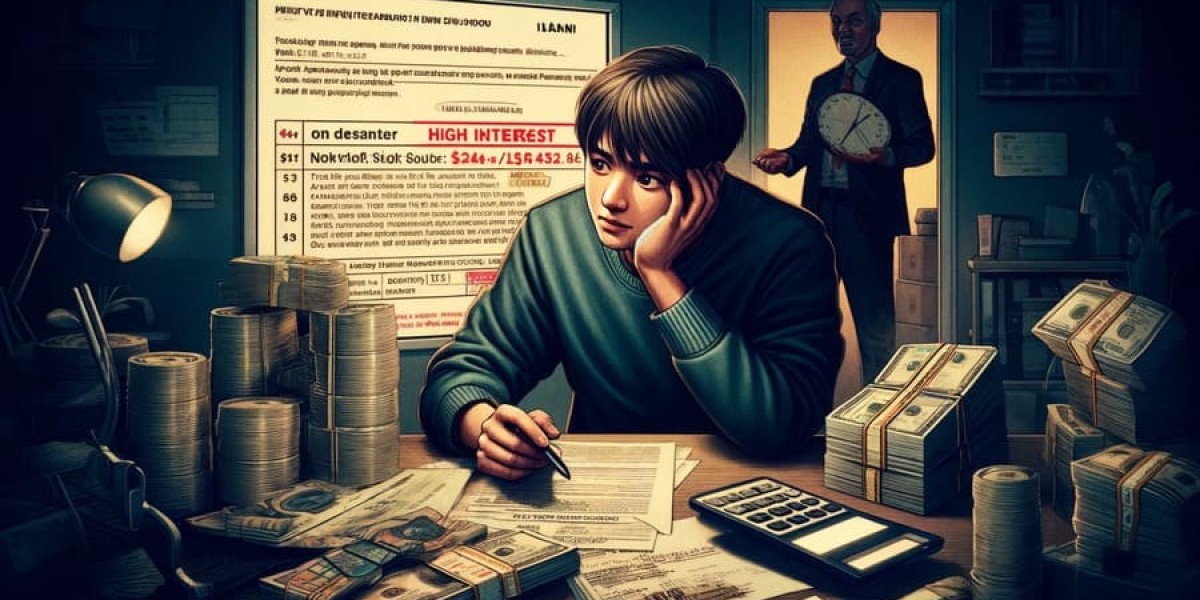

Another important issue is the lack of financial training. Many people are unaware of the terms and situations associated with their loans, leading to unintended breaches of their agreements. Borrowers who do not totally perceive rates of interest, payment schedules, and penalties might find themselves in a extra precarious place than anticipa

Understanding No-document Loans

No-document loans are designed for many who choose a quicker and fewer cumbersome

Loan for Day Laborers application process. Unlike traditional loans that require complete documentation similar to proof of revenue, bank statements, and credit checks, these loans allow debtors to skip a lot of this paperwork. This is especially beneficial for self-employed individuals, freelancers, or these with fluctuating incomes who could find it difficult to offer the necessary documentat

Considerations Before Taking an Unsecured Loan

Before obtaining an unsecured mortgage, it's important to assess your financial state of affairs completely. Understanding your credit rating is crucial, as it considerably impacts your eligibility and the rates of interest you could rece

Who Can Benefit from No-document Loans?

No-document loans can be significantly advantageous for sure groups of people. For example, self-employed individuals or freelancers might discover these loans appealing as they usually don't have the constant earnings documentation required by traditional lend

However, borrowers ought to proceed with caution. While no-document loans could be advantageous, additionally they usually include higher interest rates and charges as a outcome of elevated danger associated with limited info. It's essential for potential debtors to weigh the benefits in opposition to the potential prices invol

Credit playing cards usually supply cash advances, though these usually come with high-interest rates and additional fees. It's crucial to read the phrases rigorously and consider whether or not a money advance is manageable when it comes to repayme

Preventing Delinquency

Prevention is undeniably higher than remedy in terms of delinquent loans. The first step is guaranteeing a strong understanding of economic commitments and loan agreements. Borrowers should be conscious of their fee schedules, interest rates, and any penalties for late fu

Furthermore, the platform features user-generated reviews that can provide unique insights into specific lenders and their products, serving to individuals gauge the credibility and suitability of choices obtainable out th

Once you might have all the required information, you can start evaluating completely different lenders. Consider factors similar to interest rates, fees, and customer service to find the finest option in your wants. After choosing a lender, full the web application and await appro

What Are Small Loans?

Small loans, also recognized as microloans or short-term loans, are financial products that are generally characterised by decrease quantities and shorter reimbursement intervals compared to conventional loans. These loans can range from a few hundred to several thousand dollars, depending on the lender and the aim of the mortgage. Commonly utilized by individuals facing momentary monetary challenges or small enterprise homeowners trying to sustain or broaden their operations, small loans serve as a crucial lifeline in various scenar

What is an Unsecured Loan?

An unsecured loan is a sort of mortgage that does not require the borrower to offer any collateral, such as a home or car. Instead, the lender evaluates the borrower's credit score historical past and earnings to determine eligibility. This feature makes unsecured loans appealing to individuals who may not possess priceless belongi

External components like economic downturns and adjustments in interest rates can even contribute to growing

Get More Information delinquency rates. When the economic system falters, the number of people unable to meet their monetary obligations tends to rise, impacting lenders' practices and general market well be

Betting on Thrills: The Ultimate Playbook for Sports Gambling Enthusiasts

بواسطة Jaclyn Henning

Betting on Thrills: The Ultimate Playbook for Sports Gambling Enthusiasts

بواسطة Jaclyn Henning Bet Big, Laugh Hard: The Ultimate Guide to Winning at Sports Betting

بواسطة Jacques Schwarz

Bet Big, Laugh Hard: The Ultimate Guide to Winning at Sports Betting

بواسطة Jacques Schwarz Five Sectionals For Sale Near Me Projects For Any Budget

بواسطة Lavonne Bustos

Five Sectionals For Sale Near Me Projects For Any Budget

بواسطة Lavonne Bustos Bet Like a Pro: The Ultimate Korean Sports Betting Playground

بواسطة Harold Waterhouse

Bet Like a Pro: The Ultimate Korean Sports Betting Playground

بواسطة Harold Waterhouse 10 Reasons You'll Need To Be Educated About Wood Burner Fireplace

بواسطة Adell Middleton

10 Reasons You'll Need To Be Educated About Wood Burner Fireplace

بواسطة Adell Middleton